No one likes paperwork. But that’s what the city’s best lawyers and financial planners are for. We asked three — attorney Lisa Newman and financial planners Dusty Wallace and Tara Scottino — to tell us some of the pitfalls they wish we’d steer clear of.

Pitfall No. 1

Custody Battles

“In Texas, there are two ways you can name guardianships: it can be in your will, and we have a document called declaration of guardian for minor children in the event of death or incapacity. That’s a new-ish document. I love that document because what happens if you’re incapacitated? Nobody knows what your wishes are. And the likelihood of you getting incapacitated might be bigger than you dying while your kids are minors. And, of course, I always tell people if you have little kids, please decide who the guardian’s going to be before you come into my office. I don’t want to watch a fight about it. The thing that’s hardest for couples is deciding where their kids are going to go.”—Lisa Newman, Esq., Lisa Newman Law

Pitfall No. 2

Sibling Rivalry

“In my experience people don’t really fight about money. What they’re going to fight about is the stuff. And people revert to their relationships with their siblings when they left the house for the first time. They go back to high school relationships, and all those old grievances seem to come out. I mean, the things I’ve seen are crazy. People fighting over the silliest little thing. That’s usually one of my questions: how do you get along with your siblings? Or how do your children get along with each other? Are you guys going to be fighting over the margarita glasses or the hangers? That gets so expensive. They pay more for attorneys fees to fight over the stuff than the stuff is worth.”—L.N.

Pitfall No. 3

Lost Friends

“I walked into a very well-known executive’s office, and I went over his estate plan that was 20 years old with him. And the person he’d named as executor, he was like, ‘I haven’t talked to him in 15 years. I wouldn’t even know where he was.’ So I always tell people to pull out their documents every three to five years and just make sure that the people they’ve named, first, they’re still speaking to, and, second, they’re still alive. So if you named your parents as your executors and they passed away, that’s a good time to update your documents. When I have a husband or wife who passes away, one of the first things I do is talk about updating the surviving spouse documents.”—L.N.

Pitfall No. 4

Coming of Age

“When your child turns 18 and heads off to college, while they can probably delay getting a will, definitely get those ancillary documents [a medical power of attorney, a HIPAA authorization, and a financial power of attorney]. For example, my son is turning 18 on Saturday. Come Saturday and something happens to him, I have no legal rights to make medical decisions or financial decisions for him at that point. If he doesn’t have those documents in place, he doesn’t have someone to help him without going to court.”—Dusty Wallace, President, Strata Wealth Advisors

Pitfall No. 5

Going Over The Limit

“If you’ve purchased a lot of life insurance and you own the life insurance outright and it pays to your spouse, you are just increasing your total taxable estate for purposes of calculating the estate tax. So consider placing it into trust. If owned by a trust and it’s set up the correct way, it will not be included in your estate for purposes of calculating the estate tax. With clients who have a higher net worth, in some instances it could be the difference between having a taxable estate and not having a taxable estate. The insurance may push them over the limit, which is $13.61 million per person right now.”—D.W.

Pitfall No. 6

Facebook Forever

“We have all these digital assets now, and I’m not talking about crypto. I’m talking about Facebook accounts, Instagram accounts, LinkedIn, all of these online things. A lot of them you can go in now and name a successor person to take that over if something happens to you. I don’t know how many people know that, but I highly recommend you do that anywhere you can.”—D.W.

Pitfall No. 7

Shared Responsibility

“I’m not a big fan of having a ‘co’ in a lot of places because it can make decisionmaking harder. I don’t mind co-trustees at all, but sometimes it is difficult to make decisions if you appoint co-agents for durable power of attorney or healthcare power of attorney. Just be very thoughtful about their ability to agree. If I appoint two of my kids and one of them is like, ‘I would never pull the plug on Mom,’ and the other one’s like ‘I know Mom would want it—pull the plug,’ we are going to struggle to get to a point of action.”—D.W.

Pitfall No. 8

Checked Boxes

“When you go to the bank to open a bank account, the person that’s opening the bank account is sort of acting like an estate planning attorney, and they’re asking you how do you want to style this account. Should it be joint tenants with right of survivorship? Should it be just in your name? Should it be paid on death? And they’re really setting forth your estate plan by which box they check. And so I tell people to go check your signature cards at the bank and make sure that none of your accounts are joint tenancy with rights of survivorship if that’s not what you want. I had a client pass away and we found a bank account, and it was paid to his ex-wife, one of his daughters, and his mom—completely not in alignment with his estate plan.”—L.N.

Pitfall No. 9

Not Talking About Money

“If we have an estate of a hundred million dollars or more and a child or two, we’re likely going to have a meeting that includes the child, parents, and the attorney, and we’re explaining the family finances to the kid. Because in a lot of cases, the kids don’t have any clue that their parents have a hundred million dollars. They live up in McKinney in a $2 million house. And sure they know there’s money, but they don’t know that there’s money. Right? So yes, we encourage parents to at least cover the basics with the kids. They don’t have to go super deep, but telling the kids: where are the bank accounts? Who is your financial advisor? Where are the things?”—Tara Scottino, Partner, Senior Wealth Manager, True North Advisors

Pitfall No. 10

Misplaced Trust

“One of the biggest mistakes that I see made is a person gets this beautiful estate plan done with an attorney, and they pay $20,000, $30,000. It has revocable trusts, irrevocable trusts, and all the bells and whistles, and then they never retitle anything and change beneficiaries. So if you don’t actually fund the trusts and update titling and beneficiaries, it can completely wipe out everything you’ve done.”—T.S.

Avoid a Family Feud

Maintaining civility while splitting estates is one of life’s truest tests, and Dallas-based company TakeStock Inventory aims to facilitate. How it works: TakeStock staff can capture a 360-degree view of a home’s interior, or, for a more thorough inventory, they’ll photograph every nook and cranny, including bathroom drawers. The pics get loaded into a portal where you can attach values to each item or gather approximations with the help of an AI-powered system. Family members log in on their own time to mark the items they want, which then allows estate attorneys to moderate the divvying. No uncomfortable in-person meetups required. The TakeStock Premier service costs 50 cents per square foot; add 10 cents a square foot for AI valuation services.

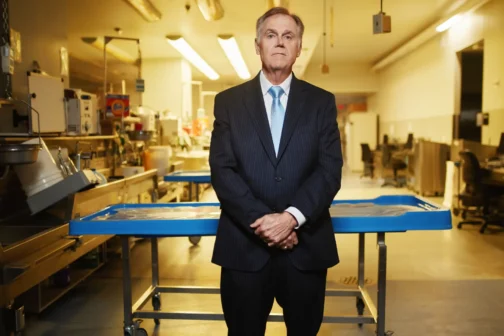

This story originally appeared in the November issue of D Magazine with the headline “Cuz You Can’t Take It With You” Write to kathy.wise@dmagazine.com.

Author