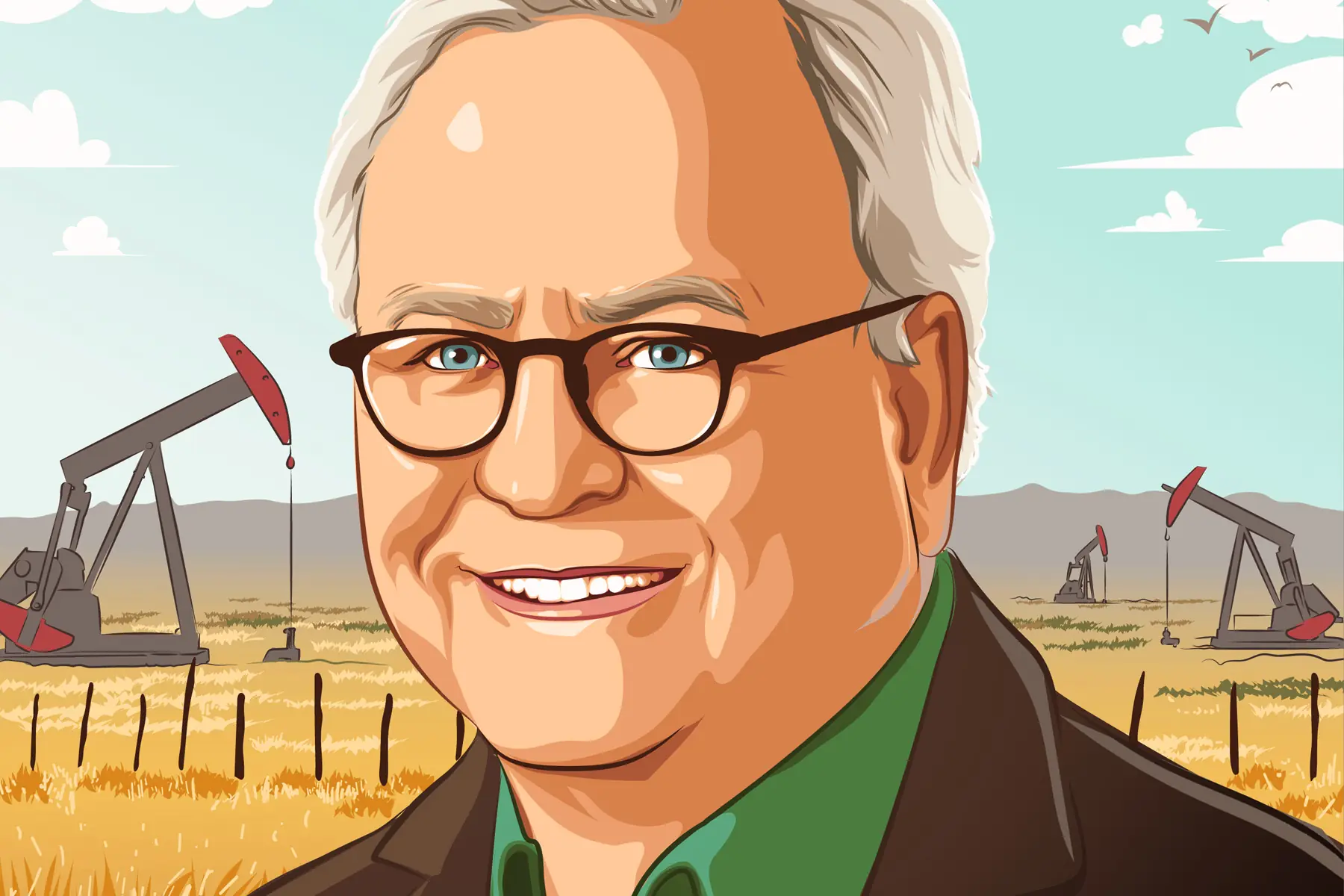

Joseph Wm. Foran is quintessentially Texan. The founder, CEO, and chairman of Matador Resources was raised in the Panhandle, owns a ranch, and has built an exceptionally impressive career in oil and gas. He was born at Camp Wolters, an Army post in Mineral Wells, while his father served in the Korean War. Growing up in Amarillo, he worked in the oil fields in high school. “The big field was the Panhandle, which was still being drilled at the time,” he notes.

The Panhandle is considered one of Texas’ greatest petroleum reserves, save the Permian.

Foran attended law school in Dallas at SMU on a merit-based Sumners Foundation scholarship—one of five scholars who received a full ride. But he came to the realization that the practice of law was not for him. In a career soul-searching exercise, he wrote down the names of the people he admired most on a piece of paper. They were all connected to oil and gas.

So, he mustered up his Texas gumption and made a bold decision to form an energy company, convincing 17 friends and neighbors to contribute $15,000 each to fund it. Five years later, in 1988, he reorganized Foran Oil Co. as Matador Petroleum, rolling partnerships he had established together in the manner of T. Boone Pickens’ Mesa Petroleum.

Foran attributes his early success to key directors, including oil and gas luminaries Marlan Downey from ARCO and Shell and Jack Sleeper from Pickens’ enterprise. They gave him credibility in the mid-1980s, when oil plummeted from $35 a barrel to $10. “[Boone and I] worked well together and became friends,” Foran says. “Both of us were from Amarillo with paper routes being in common, too. He gave me valuable insights and advice and was more often right than wrong,” he adds, with his typical dry, multi-layered wit.

On Sept. 10, 2001, the day before the terrorist attacks, Foran received approval to take Matador Petroleum public. He chartered a plane to fly to New York. But the chaos following 9/11 put everything in disarray. And Foran, who had been following a conventional acquire-and-exploit strategy, shifted to take Matador down the industry’s new path. The company became part of the big shift to horizontal drilling and hydraulic fracturing—that is, the shale revolution.

Horizontal drilling began in the Delaware Basin in New Mexico around 2003, Foran notes. “In Texas, it was all about big ranches where series of wells couldn’t be drilled by the majors,” he says. “In New Mexico, you could aggregate smaller groups of acreage. You’d get a section and be happy with it, right? You could get things done, and it seemed to fit us as we grew along.”

In June 2003, Foran sold Matador Petroleum to Tom Brown Inc. for $388 million in an all-cash deal. The following Monday, he founded Matador Resources. Just shy of a decade later, on April 15, 2013, Foran and his team rang the bell at the NYSE, a little more than a year after the company began publicly trading.

These days, Foran is leaning more into “exploration and knowledge of geology.” He prioritizes recruiting, attracting talented students from 15 schools, including Colorado School of Mines, The University of Texas, Texas A&M, and Oklahoma State.

He points to stats of other publicly traded companies to highlight the efficiency of the oil and gas industry, comparing, for example, Matador’s 400 employees and an $8 billion market cap to Harley-Davidson’s 6,400 employees and $5 billion cap.

Surrounded by the waves of industry consolidation, Foran reveals an open-minded attitude built by years of experience. “I never say, ‘I’ll never do that,’ right?” Meanwhile, Matador is expanding its Delaware Basin footprint, making its biggest buy ever—Ameredev. The $1.9 billion purchase price stands in contrast to the company’s more classic “brick-by-brick” efforts of deals past.

Matador had record production and a record number of operated wells in the second quarter of 2024. One result of the Ameredev acquisition, in addition to its stock outperformance post-announcement, is peer-leading productivity ahead. The fortuitous high oil cuts of 84 percent from new drilling resulting from its 2023 acquisition of Advance Energy Holdings is helpful.

Foran is extremely proud of his team’s technical prowess, showcased with a visit to Matador’s drilling tech room. There, his executive vice president of reservoir engineering, Tom Elsener, walks through descriptions of how the various rock has their gamma-ray signatures and the attributes of various zones. A 3D-seismic visual on a massive screen shows the Texas and New Mexico state line, where 2,800 acres feature an intricate web of zones and wells drilled and geo-steered through to precision.

Young geologists and engineer types share their own stories about the rock. Notable are the novel “horseshoe” (as Foran describes) or U-turn wells, initiated in 2023. An early adopter of this innovative technique, Matador saved $10 million last year, and there’s more ahead. For Foran, sustainable growth is all in the details.

Throughout it all, the Permian’s Delaware Basin has served Foran, his longtime investors, and his Matador employees very well. In his latest earnings report, he spoke of the company’s approach of “working together to build the value of Matador for our shareholders, staff, vendors, stakeholders, and other friends from its original capitalization of $270,000 to approximately $8 billion.” Ninety-five percent of Matador employees own shares.

In his office, Foran’s love of family, sport, his ranch in Claude, and keepsakes from friends shine through. He relishes new talent at Matador but often expresses gratitude to the people who started the journey with him—and those who continue to stay.

Author