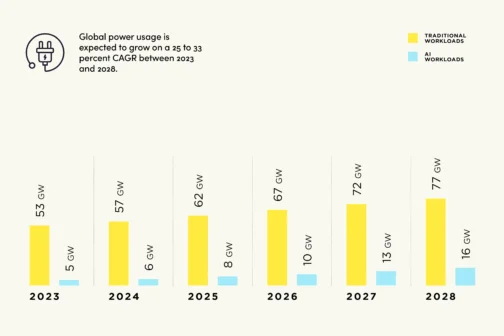

Dallas business leaders—astute, seasoned or young—are leaning into a cresting wave of opportunity in energy. Their visions include the hunt for good rock with the right gamma-ray signature, hyperscale computational power and a Starlink connection, and everything in between. The prize could be big on two fronts: emerging world hydrocarbon demand and tech’s endless thirst for power. Things have gone from what essentially has been flat-lined electricity growth in the U.S. to the potential of 100 “peak-capacity” gigawatts (GW) being added by 2030, Goldman Sachs reports. Last year, peak demand was 740 GW, with Texas accounting for more than 10 percent.

Playing into the perfect storm, large U.S. regional grid operators report a mismatch between decommissioning power generation and a lack of new generation coming online between now and the end of the decade. These reliability reports were like siren calls, says Danny Rice, chief executive of NET Power, which transforms natural gas into clean energy through an oxy-combustion process. “We don’t have time,” he says of the widening gap between supply and demand. “It’s easier to add new load growth, especially from AI and data centers, than it is to add new generation capacity from, say, nuclear. That leaves natural gas to meet the demand.”

“Texas is a big piece of our portfolio, and the shining star is Dallas.”

Andrew Power, CEO, Digital Realty

Seemingly strange bedfellows are jockeying to procure energy. In this new era, firms can’t do it alone. They’re merging, consolidating, fortifying, and developing new partnerships across the hydrocarbon, electron, and even cryptocurrency aisles. Add to that, “We’re in a technological arms race,” notes Andrew Power, CEO of Digital Realty, a publicly traded data center pioneer. Energy underlies its success. The runway for oil and gas looks long.

Hydrocarbons are “still a growth industry”

Last year, energy M&A deals topped $234 billion as oil and gas companies fortify and retool for the future. Dallas’ Pioneer Natural Resources was the bellwether independent shale producer, an epic oil success story, and now a subsidiary of super-major ExxonMobil, which acquired it for $63 billion. In the first quarter of this year alone, energy M&A deals were valued at $73 billion, with global major Chevron packing up and moving to Texas from California. For the most part, cash and size are king.

But global market competition, disruptive technology, and entrepreneurial vision play a role, too. Demand for oil and gas is not abating, despite a decarbonization drive. Fourth-generation oilman and Heyco Energy CEO George Yates, with his hindsight, notes “hydrocarbons are still a growth business.”

Peak global projections range from 106 million barrels per day (mbd) through 2029, according to the International Energy Agency, and 116 in 2045 by OPEC. But it could go higher yet by transforming globally abundant gas into liquids. With U.S. oil production hovering around 13 mbd, we could see 14, but 15 or 16 is a stretch, according to Yates, given the depletable nature of oil.

Consolidations have occurred as long as the industry has existed. This time around, Yates says, “I think it’s different in degrees, though not completely. Consolidations are typically the product of the majors or large companies using one of their big strategic advantages, which is capital.”

Independents are also selling, due to aging leadership, retirements, and legacy planning. Non-core acreage sold by the large consolidators will be picked up by the independents. Across decades to the 2010s, the independents acquired and aggregated acreage left behind by the majors in the run-up to the shale revolution. The rebuilding of inventory may be different this time around.

Another wave of opportunity is international, notes Yates. Alongside his U.K. and Spanish subsidiaries, the energy CEO is eyeing massive new fields where large, unfettered blocks of land will yield “the prize”—shale’s promise of greater resource recoveries. And, Yates notes, we don’t yet know what future technology will impact demand tomorrow’s opportunity. “I’ve seen M&A cycle through with an important effect on the structure of the industry,” he says. A new day may be dawning.

Cleaner and Decarbonized Energy

In a 2009 D CEO interview, Pioneer Natural Resources leader Scott Sheffield prophesied that it would be a global gas world for the next 40 to 50 years. By 2022, the advent of global gas was diffused, and two years later, U.S. liquified natural gas is awash on more shores, owing significantly to Russia’s invasion of Ukraine. Energy security is a driver. The U.S. is the largest global producer of natural gas, with North Texas players once again setting the table.

As the world continues to reset post-pandemic, countries are recognizing the need to utilize their indigenous resources. The growth of global gas is thought to be an Asia-leaning chapter for the next decades. Maybe. “For the last 100 years, societies across the world have focused on two things: reliability and affordability,” says Rice. “Over the last decade, a focus on a third criterion has emerged—cleaner and decarbonized energy.”

A Dallas resident, Rice decided to launch an oil and gas firm—with little experience—in Appalachia’s early days of shale gas around 2007. He and his two brothers, representing finance, geology, and petroleum engineering, cobbled together 100 acres here and 200 there, went public with Rice Energy in 2014, and then merged into EQT in 2017. The brothers, including now-chief executive of EQT Toby Rice, became owners of the largest natural gas-producing firm sitting atop one of the largest natural gas fields in the world, the Marcellus. (Trevor-Rees Jones of Dallas’ Chief Oil was also important in the Marcellus Shale’s breakout story.)

NET Power is a unique shift from being an Appalachian wildcat-producer to the downstream application of power generation. Danny Rice is applying IP that will decarbonize natural gas power generation. A 50-megawatt demonstration project in La Porte, Texas, and a Permian utility-scale project, alongside Occidental Petroleum for carbon sequestration or enhanced oil recovery, are just the beginning.

Many believe decarbonization is moving away from fossil fuels to get clean power, Rice surmises. According to his calculations, it is cheaper to start with the lowest-cost energy feedstock on offer in the United States—natural gas—and capture and remove the CO2. “We have a better solution than the path you’re heading down with renewables and batteries,” he says.

Discussing greenhouse gases at a neighborhood coffee shop, Rice relays the science: “There’s too much dilute CO2 escaping into the atmosphere, mostly from power generation and from other industrial sources,” he says. “Ultimately, we solve this by essentially replacing those carbon-emitting power plants.”

As for methane, where attention is also directed, Rice notes: “We know firsthand just because we run the largest natural gas producer in North America where our methane emissions are—they are like a rounding error.”

The Inflation Reduction Act of 2022 incentivizes this evolving natural gas ecosystem. NET Power’s novel IP moat locks down a standardized power plant design that is unseen in the thermal power industry. Rice counts a potential of 900 power plants in the U.S. and globally. His gas plant has a carbon intensity profile the same as wind and solar, with a price tag 30 to 50 percent lower. Netpower’s first utility-scale plant, operational in late 2027, will be “expensive, but the cost curve will decline, and then we really start to distance ourselves,” Rice says. He figures his plant outcompetes even small-scale nuclear on a generation basis. “It is quite profound,” he says.

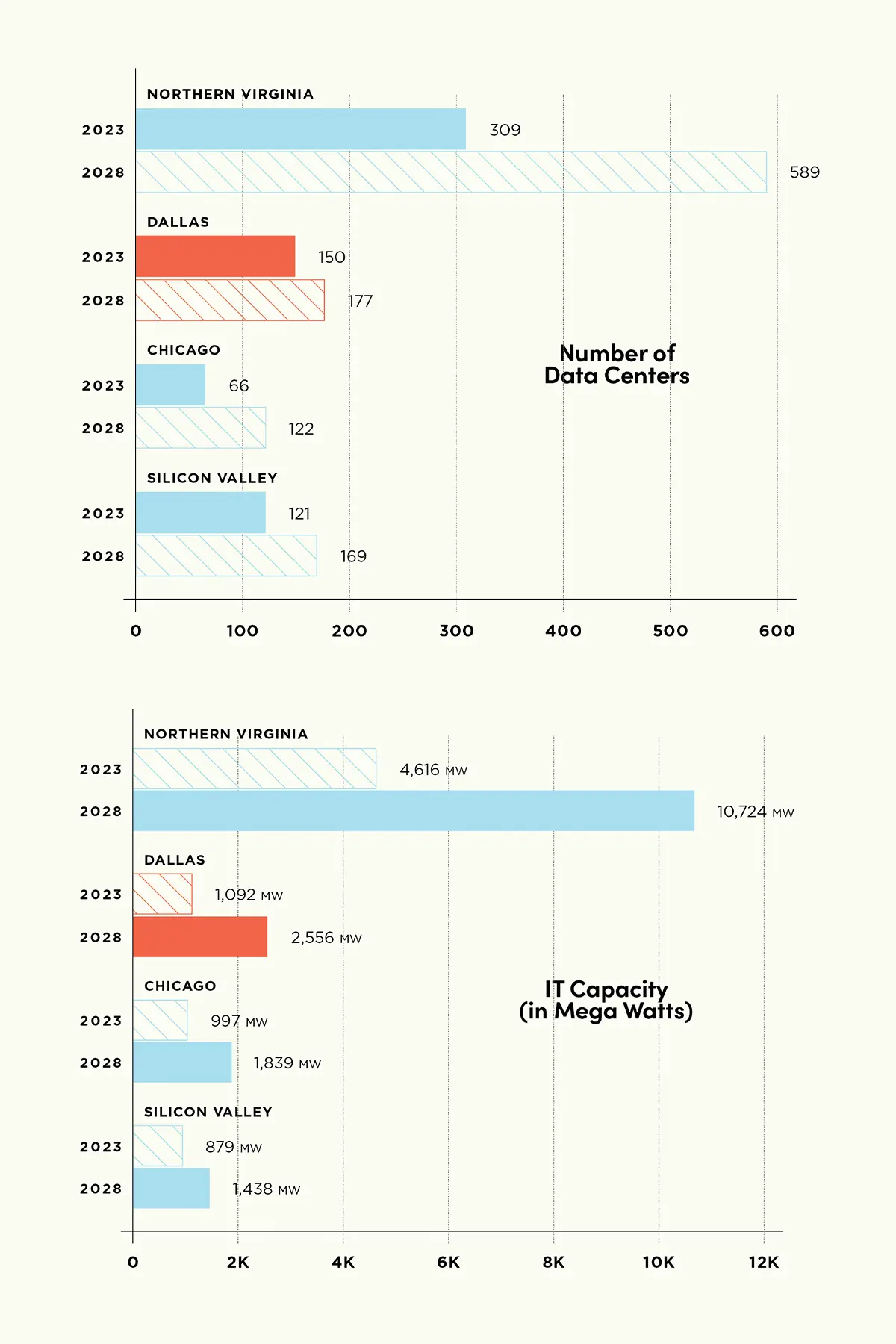

Top U.S. Data Center Markets

Technology is driving a fierce demand for data center space—and the energy that powers them.

‘AI is Just Getting Started’

To help quench its insatiable thirst, Big Tech must ally with oil and gas even as enterprises seek greener sources from renewables and denser forms of energy like nuclear. Beyond data centers, power is needed for semiconductor ecosystems and next-gen reshoring; bitcoin, crypto and decentralized platforms (Web3); and the demands of mega-computing power.

Digital Realty CEO Power knows firsthand about energy demand with the AI frenzy that began in earnest in the spring of 2023. It reached a crescendo after AI infrastructure darling Nvidia resorted to its 10-1 stock split of the $1,200 stock in June, from a 709 percent run-up since early 2023. “At an investor day in 2017, our CTO was seeing AI coming next, and we need to get ready to push our infrastructure,” Power says. “Think about cooling and power densities.”

Digital Realty had record bookings in the first half of 2024, particularly large-capacity blocks driven by AI. The company serves 5,000 customers around the world in 50-plus metropolitan areas and six continents.

Power’s career began in Digital Realty’s early days in downtown Dallas two decades ago. “Our biggest customers are the hyperscale cloud computing companies, headquartered in the Pacific Northwest down to Silicon Valley,” he explains. Think Amazon, Meta, Google, and Nvidia. The data center phenomenon emerged alongside these firms involved in digital transformation, then cloud computing, and now generative AI. “Cloud computing is not nearly done, and AI is just getting started,” Power says.

Interestingly, Digital Realty has been quantifying its capacity in energy terms—kilowatts, megawatts, and gigawatts. This captures the energy use from substation to the data center. With its 2.5 GW data center portfolio and another 3 gigawatts of future runway of growth, the company is ready with land secured and access to power.

“Texas is a big piece of our portfolio, and the shining star is Dallas,” Power says. The Texas portfolio is 100 percent green. From the CEO’s perspective, it’s not just a Texas energy system challenge but more national. “With a power demand profile that was flatlining,” he says, “today, we’re shocking it and saying, ‘Now run a marathon at a sprinting pace.’

“If you want something scaled up and contiguous, fast, you go [to the U.S.] before Europe and other parts of the world,” Power says. About the rush, he cautions restraint given the heavy investment requirements—of substations, power production, transmission, data centers—to avoid booms and busts. He notes a “reshaping of the global data center landscape, with AI driving the incremental wave of demand.” The public cloud services market is projected to grow by more than 20 percent in 2024, reaching $675 billion and 22 percent in 2025, according to Gartner’s industry data.

Power says it’s hard to forecast demand far in advance. “I can tell you it feels very real, the activity and the flurry of these customers; it feels early,” he says. As proof, Digital Realty had a record $252 million in new leases for the first quarter, added to a backlog of $541 million. Power casts about for his sense of it. “It feels like it’s going to be big,” he says. “I can’t tell you how big or how it’s going to play out.”

M&A Activity Sweeping Through the Oil Patch

There is a call on the midstream sector, the middlemen to the restructuring, and innovating producers, owing to the demand for more feedstock, derivative products, and electrons—everywhere. In the U.S., it’s a complex logistics play mastered over decades by Dallas’ Energy Transfer.

The company is no stranger to M&A activity sweeping through the oil patch either. It has grown significantly through acquisitions, including large deals like Southern Union for $8 billion and Sunoco for $5.3 billion, which reshaped Energy Transfer’s natural gas-weighted portfolio. “It’s just been a big part of the DNA of Energy Transfer,” says Tom Long, a co-CEO at the company. “Even these acquisitions that are over $7 billion—you call them bolt-ons.”

Energy Transfer’s executive team continues to build on the vision of Founder and Chairman Kelcy Warren. It has manifested into a full spectrum of hydrocarbon streams connecting virtually every U.S. basin to demand centers whether cities, ports, or nations.

Long spent his early career developing large-scale petrochemical facilities on Texas’ Gulf Coast and in Saudi Arabia. Although midstream is core, Energy Transfer is now moving into downstream spaces, as well. It’s the wellhead-to-water strategy that its massive scale allows for. Long is deeply familiar with Energy Transfer assets. In 1989, he was part of the largest natural gas pipeline merger in history, the $3.2 billion Texas Eastern and Panhandle Corp. tie-up, of which its valuable Trunkline LNG assets are a part.

After 45 years, Long knows where all the bones are buried and the pipes are laid.

Crude oil became a significant part of Energy Transfer’s portfolio following the acquisition of Sunoco. Massive volumes are transported through its Dakota Access pipeline—500,000 to 600,000 barrels per day—heading for the Gulf Coast. “The company has invested heavily in export terminals to handle natural gas liquids (NGL) streams, particularly at the Nederland terminal, which exports about 20 percent of the entire U.S. NGL streams through multiple docks. Long calls it “Flexport,” a distinctive capacity wherein eight to nine docks process over one million barrels per day of NGL, chilling and loading them in a type of synchronicity. “That increases your export capacity on a continuous basis even more,” Long explains.

Alongside exports, Energy Transfer’s global expansion continues, with offices in Beijing, Panama, and now Singapore for crude oil trade. India and the Middle East are in consideration. With a weather eye on Latin America, it was approached about building out pipelines in Argentina to increase its oil production possibly five-fold. The company’s transported oil volumes grew by 44 percent during the first quarter of 2024 to 6.1 million barrels per day, owing to acquisitions.

With regulatory constraints for new interstate pipelines, the value of existing assets has increased, Long says, crediting an optimization team that folds in new assets. Moving volumes of natural gas efficiently “from the largest supply areas to the heaviest demand centers,” such as from the Marcellus and Utica to Gulf LNG facilities, is a priority, Long adds.

Recently highlighted was 233 billion cubit feet (bcf) of gas storage along all its systems and upward of 9 bcf of power plant and data center deals. Come what may, Energy Transfer is ready.

‘Welcome to the Party’

An emerging generation is cutting new trails in oil and gas, with a greater good kind of vibe. Bitcoin miners are developing tech solutions in unchartered territories in blockchain and energy. However, competition from the hyperscalers—flush, power-hungry firms—may overthrow even the new models of bitcoin miners. “Three years ago, everything [in mining] was based on production and hash rate,” says Christopher Alfano, CEO of 360 Mining. “Now, the value lies in interconnection and power contracts. In my opinion, bitcoin miners will be displaced by better-capitalized entities that can pay more [for energy].”

“I didn’t expect AI to make on-grid mining less viable so quickly.”

Christopher Alfano, CEO, 360 Mining

360 Mining, with its original pilot facility outside of Fort Worth, has morphed into an oilfield service provider. A 30-year-old graduate of SMU, Alfano says, “We’re an oil and gas company using bitcoin mining to achieve better gas prices and lower emissions. Originally, in 2021, we were a bitcoin miner using gas for cheap power.” In early 2023, after re-fracking wells and realizing the potential, Alfano says, “the market found us —needing solutions for stranded gas and tighter emissions controls.”

Alfano expects other miners to move further up the supply chain, co-locating at power plants and further upstream to natural gas wellheads. He observes, “I didn’t expect AI to make on-grid mining less viable so quickly, but bitcoin mining gravitates toward the lowest cost of power.” He points to publicly traded miner Hub8’s move upstream by purchasing a natural gas plant in Canada.

The bitcoin mining industry receives its fair share of criticism, whether it’s noise, competing with traditional energy users, or its net value to society. “We’re right at home with the oil and gas industry,” Alfano says. “They look at us like, ‘Welcome to the party. Now you know how it feels to be beaten down.’”

Across five mining sites, 360 Mining’s power usage is about 10 to 20 megawatts in total. In the U.S., miners’ use of power gen is estimated to fall between 0.6 and 2.3 percent of total U.S. electricity consumption. Data centers currently use roughly 4 percent and are forecast to use 8 or 9 percent by 2030, note analysts at McKinsey.

Miners are catalyzing innovation in grid optimization called “demand response.” They can shut down operations to free up a stressed grid in a nanosecond. Nuclear power plants are showing interest, too. Immersion cooling has become the rage for miners and data center operators trying to cool hot servers and save on energy costs. “We focus on solving the natural gas problem,” Alfano says.

Other parts of the world with stranded gas assets are attracting miners as well, in Africa, the Middle East, and Kazakhstan. “This technology can also unshackle more barrels of oil,” Alfano says. And then, once customers get their just deserts, a reward in this case, they have bitcoin. After going down the bitcoin learning curve “rabbit hole,” some often choose to hold bitcoin rather than convert it.

About bitcoin’s allure, Alfano enthusiastically relays, “Anyone with an internet connection, anywhere in the world, can transmit value without any counterparty interfering with your transaction and taking huge fees.” His Starlink internet connection—the satellite-based constellation owned by Elon Musk’s SpaceX—optimizes operations in the dual-purpose gas and mining field.

Emerging industry leaders are hyper-aware of the confluence of energy provision, technology sharing, and prosperity. Vice Chair and Chief Operations Officer Lauren Yates, a fifth-generation executive at Heyco, says, “From the parent company perspective, my role is to make sure we’re all operating under the same vision and strategy.” The company’s European technical team retreated to field operations in New Mexico, their “Matador University,” to witness shale technology firsthand.

Yates notes that the economic multiplier of Heyco’s operations in Spain and the U.K. mean potentially hundreds of thousands of jobs ahead. In Spain, 1,100 first-time royalty checks were received in the mail from legislation her father initiated and pushed. The potential savings on carbon and methane from local gas production in Spain to replace NGL from the U.S. and pipeline gas from Algeria is significant, too. “We’re bending the curve,” CEO George Yates says.

At an inflection point, North Texas firms are innovating in the field, rethinking technologies and advancing economies. That’s impact. Oil and gas and electrons are being disrupted equally. Nothing seems off the table. A center of gravity circling energy is being shifted once again.

“Looking for a Wire”

Nineteen gigawatts of load are expected to ramp up in Texas over the next two-and-a-half years.

Texas understands the need to reliably power its mega-sized growth economy. The state’s legislature incentivized natural gas-fired power in 2023 with $5 billion in low-interest loans, since upped to $10 billion. The program was originally oversubscribed eight times to take the grid from 85 to 150 gigawatts (GW) by 2030.

In looking at future power generation “load growth” in Texas, ERCOT estimates approximately 150 GWs to 2030, compared to a peak load of 86 GW in 2023. Of this, the electrification of the Permian Basin is 24 gigawatts and other large loads of 41 GW, for hydrogen and related manufacturing, bitcoin mining, and data centers.

Don’t forget reshoring semiconductor plants, as well as advanced manufacturing and their supply chains. Victor Sauers, chief executive of TKO Energy, is most concerned about the 19 GWs of load expected to ramp up in Texas over the next two-and-a-half years, driven by real construction and projects “looking for a wire.” That’s equivalent to adding one California.

A constraint for renewables development is the interconnection queue lengths. Sauers notes that Texas’ backlog is about one to two years, and at the federal level, with the Federal Energy Regulatory Commission, it’s 10 to 12 years. Adding transmission lines presents a longer wait time. More than 150 GW of solar is in the ERCOT queue and 105 GW of energy storage. The best wind sites are exhausted, and solar projects are hunting for ground and wires, Sauers says.

Renewables may be on-grid faster as gas turbines have a waitlist of over three years, a supply chain problem. Meanwhile, industrial users are making deals behind the meter, buying their own power facilities in solar, wind, nuclear, and gas-fired power generation.

Energy Transfer is being approached by data centers, plus building eight 10 megawatt (MW) gas plants for its own use. Amazon announced a 200 MW project at a nuclear plant it bought. “The load is just so big in Texas and in renewables,” Sauers says.

Author